Property installment calculator

An installment sale of property used in your business or that earns rent or royalty income may result in a capital gain an ordinary gain or both. EMI towards your home loan.

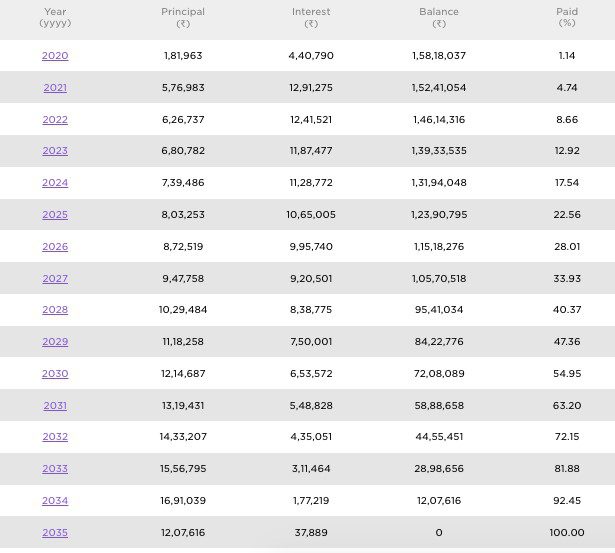

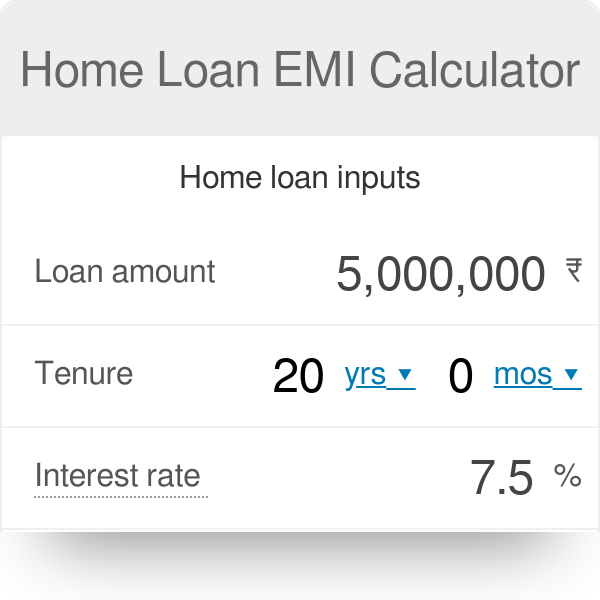

Home Loan Emi Calculator How To Use Housing Com Emi Calculator

Section 179 deduction dollar limits.

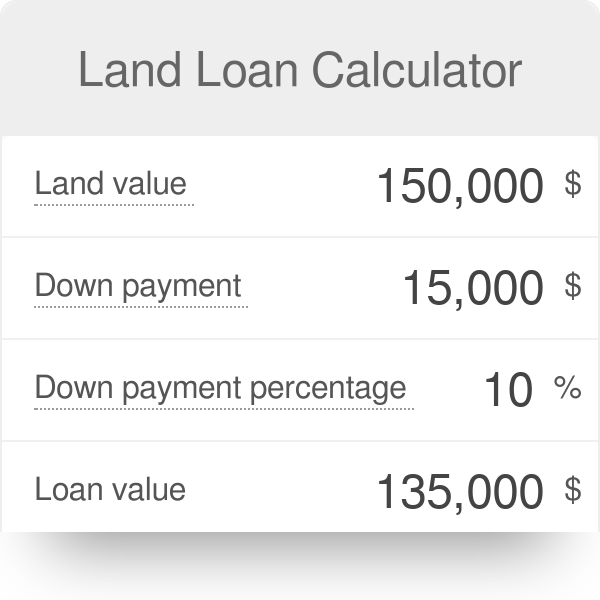

. Sometimes referred to as a land installment contract this allows the buyer to pay the land owner in installments over a predetermined period of time. But taxpayers may be able to avoid paying this fee by signing an installment agreement. July 4 end of day - 2 penalty added.

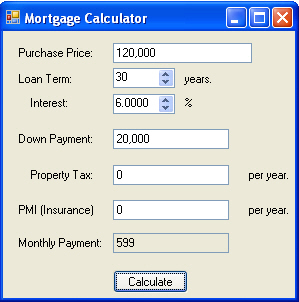

The second installment property tax bill is mailed and due in late summer. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement. The equation to find the monthly payment for an installment loan is called the Equal Monthly Installment EMI formula.

See also Shay v Penrose 25 Ill 2d 447 185 NE2d 218 1962. Please contact us mybillstaxnanaimoca if you do not receive your Property Tax Notice by the second week of June. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

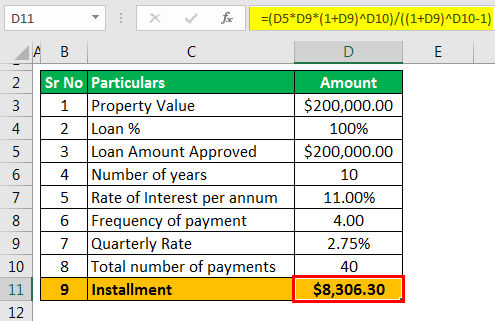

Property or services received instead of money as rent must be included as the fair market value of the property or services in your rental income. R Monthly RD installment to be paid n Number of quarters tenure i Rate of Interest 400. The options in our database are limitless.

Property taxes in Wisconsin can be paid on two different installment schedules. Home Loan EMI Calculator assists in calculation of the loan installment ie. Most home equity lenders allow you to borrow a certain percentage of your home equity typically up to 85 percent.

The first requires all taxes to be paid by Jan. Calculate the monthly instalment on your new car based on the car price and loan interest rates. New Car Instalment Calculator.

The first installment is supposed to be equal to 50 of the total property tax bill from the previous tax year. Get 247 customer support help when you place a homework help service order with us. If you have an installment plan in place your property cant be sold out from under you and you will retain the right to redeem the property.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. The upside of contract for deed financing is that it is often easier to obtain. It applies to property taxes that have been delinquent for a year or more and will allow you to make up to five catch-up payments.

How much do I need to make for a 900000 house. PITI is an acronym that stands for principal interest taxes and insuranceAfter inputting the cost of your annual property. 2022 Property Taxes.

Harris County residents can pay their property tax bills online over the phone or in person by visiting one of the countys branch office locations. The calculator will then reply with an income value with which you compare your current income. It reflects new tax rates levies changes in assessments and any dollars saved by exemptions for which you have qualified and applied.

If the payment for your secured property taxes isnt postmarked by its deadline Dec. The penalty charge is. Buses - Charter.

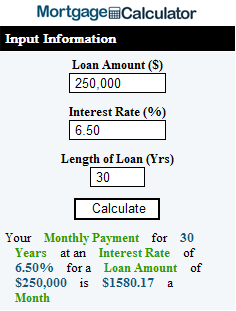

An equated monthly installment EMI is a fixed payment amount made by a borrower to a lender at a specified date each calendar month. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. A home equity loan is an installment loan based on the equity of the borrowers home.

This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning. 10 for the first installment and April 10 for the second installment your taxes become delinquent and youll face a 10 penalty. Use this PITI calculator to calculate your estimated mortgage payment.

Apply for an ITIN. Unpaid balances are subject to penalties per the Community Charter. The 2022 Property Taxes will be mailed around mid-May and are due on July 4 2022.

There are 80082 Properties For Sale In Kuala Lumpur you can use our elegant property search tool to find the right terraced house condominium apartment semi-d bungalow and land that is currently sale. The other methods listed also use EMI to. By law the first installment property tax bill is exactly 55 percent of the previous years total tax amount.

Apply for Power of Attorney Form W-7. It an easy to use calculator and acts as a financial planning tool for a home buyer. 31 and July 31 respectively.

This would require them to knock out their unpaid property taxes interest and penalties in six months. This will allow you to redeem the property on which back taxes are owed. AmendFix Return Form 2848.

For trade or business property held for more than 1 year enter the amount from line 26. How Wisconsins Property Tax Works. Mortgage loan basics Basic concepts and legal regulation.

If youre mailing your payment youll need to make sure its postmarked by the installment due date. For example your tenant is a painter. 31 while the second allows for more flexibility with two equal payments due by Jan.

A 900000 home with a 5 interest rate for 30 years and 45000 5 down requires an annual income of 218403. All or part of any gain from the disposition of the property may be ordinary gain from depreciation recapture. Typically there is a final balloon payment that further compensates the seller for financing the purchase.

Tax payments can be made in four ways. If you file late we will charge a penalty unless you have a valid extension of time to file. 5 of the tax due for each month or part of a month the return is late up to a maximum of 25.

Wedding Limousine Services. The first installment is due on Nov. 2022 Property tax rates.

1 and the second installment is due the following year on Feb. Helps brings focus on property search The EMI calculator helps you arrive at the right home loan amount that best fits your monthly budget by helping. 2022 property tax rates are set by Property Tax Bylaw 10M2022.

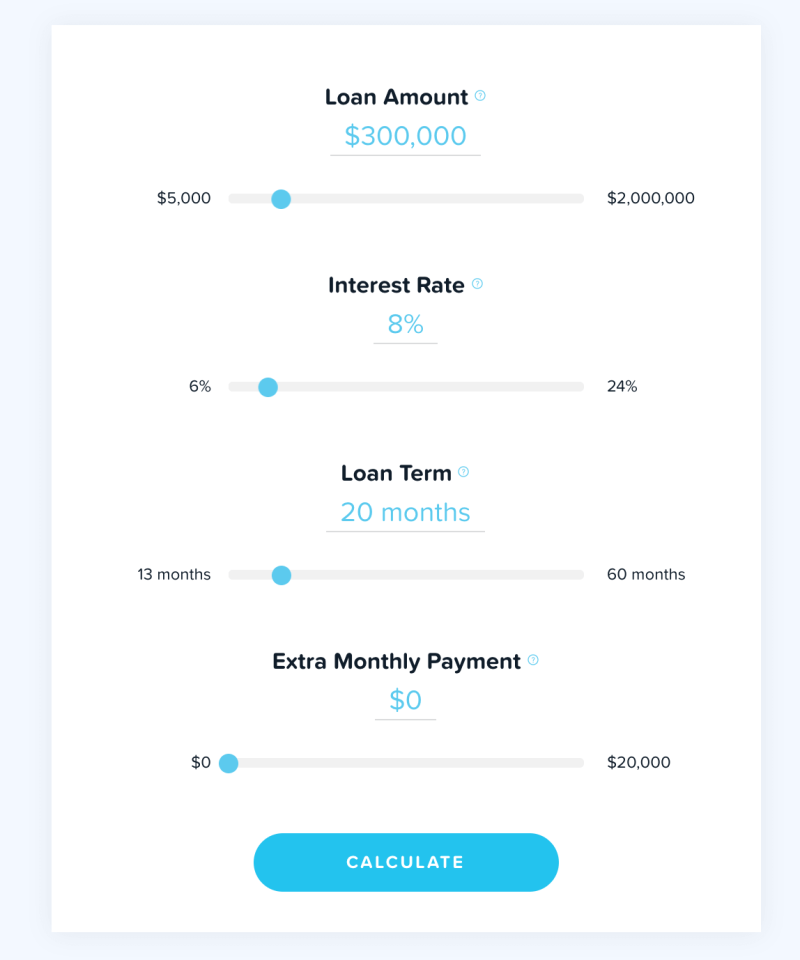

It is defined by the equation Monthly Payment P r1rn1rn-1. Under an installment contract the buyer gets possession of the property and makes installment payments of the purchase price over an extended period of time to the seller who conveys legal title to property once the purchase price is fully paid. Equated Monthly Installment - EMI.

For information on how the tax rate is determined or how your tax bill is calculated visit Tax bill and tax rate calculation or visit the Property tax calculator to. Installment Agreement Request POPULAR FOR TAX PROS. Penalty for late filing.

Land Loan Calculator

Home Loan Emi Calculator 2022 Free Excel Sheet Stable Investor

Mortgage Calculator Script Free Mortgage Calculator Widget

Extra Payment Mortgage Calculator For Excel

Mortgage Calculator With Down Payment Dates And Points

Mortgage Calculator In C And Net

Loan Repayment Calculator Personal Loans Mortgages Repayments Disabled World

Land Loan Calculator Land Mortgage Calculator

Free Mortgage Calculator Free Financial Tools Transunion

Home Loan Eligibility Affordability Calculator

Home Loan Emi Calculator

Loan Repayment Calculator Step By Step Guide With Examples

Mortgage Calculator How Much Monthly Payments Will Cost

Calculate Mortgage Rates With The Mortgage Calculator Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Loan Calculator

Va Mortgage Calculator Calculate Va Loan Payments

Easy Commercial Mortgage Payment Calculator Lendio

Loan Calculator That Creates Date Accurate Payment Schedules