Roth ira contribution calculator 2021

You can contribute up to 20500 in 2022 with an additional. Open A Roth IRA Today.

Taxable Income Calculator India Income Business Finance Investing

You may contribute simultaneously to a Traditional IRA and a Roth IRA subject to eligibility as long as the total contributed to all.

. The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. The Roth IRA has a contribution limit which is 6000 in both 2021 and 2022or 7000 if you are 50 or older. Annual IRA Contribution Limit.

And Roth contribution calculator. For 2021 and 2022 the most you can contribute to Roth and traditional IRAs is as follows. You cant make a Roth IRA contribution if your modified AGI is 208000 or more.

Save for Retirement by Accessing Fidelitys Range of Investment Options. 9 rows Subtract from the amount in 1. The amount you will contribute to your Roth IRA each year.

Roth IRAs have an. Maximum Contribution for individuals age 50 and older. Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals.

Use AARPs Free Online Calculator to Calculate Your Tax Deferred Growth. The amount you will contribute to your Roth IRA each year. The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of.

7000 if youre age 50 and up 3. Less than 140000 single filer Less than 208000 joint filer Less than. For comparison purposes Roth IRA and regular taxable.

Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service. Get Up To 600 When Funding A New IRA. Eligible individuals age 50 or older within a particular tax year can make an.

Ad Explore Schwabs Infographic To Understand IRA Differences And Contribution Limits. Contributions are made with after-tax dollars. The Sooner You Invest the More Opportunity Your Money Has To Grow.

Ad Its Time For A New Conversation About Your Retirement Priorities. Your filing status is single head of household or married filing separately and you didnt live with your. Roth Conversion Calculator Methodology General Context.

This limit applies across all IRA accounts. Get Up To 600 When Funding A New IRA. Ad Explore Your Choices For Your IRA.

Roth IRA contributions are limited for higher incomes. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track. This calculator assumes that you make your contribution at the beginning of each year.

Wed suggest using that as your primary retirement account. Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly. We Go Further Today To Help You Retire Tomorrow.

This legal loophole enables high-earners to open a traditional IRA make contributions then immediately convert. Use these free retirement calculators to determine how much to save for retirement project savings income 401K Roth IRA and more. For 2022 the maximum annual IRA.

Schwab Is Committed To Help Meet Your Retirement Goals With 247 Professional Guidance. 198000 if filing a joint return or. Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service.

Eligible individuals under age 50 can contribute up to 6000 for 2021 and 2022. The amount is increased to an. Ad Dont Pay Taxes When You Withdraw Your Money After You Retire.

This calculator assumes that you make your contribution at the beginning of each year. If you have a 401k or other retirement plan at work. Roth IRA Calculator.

For 2022 the maximum annual IRA. Ad Learn About 2021 IRA Contribution Limits. Free Roth IRA calculator to project how much youll need in retirement.

This calculator assumes that you make your contribution at the beginning of each year. If your income falls in a phase-out range you are allowed only a prorated Roth IRA contribution. 6000 if youre younger than 50.

Open a Roth IRA Account. The amount you will contribute to your Roth IRA each year. For 2022 the maximum annual IRA.

Save for Retirement by Accessing Fidelitys Range of Investment Options. Explore Choices For Your IRA Now. Ad Contributing to a Traditional IRA Can Create a Current Tax Deduction.

You can contribute to a Roth IRA if your Adjusted Gross Income is.

Roth Ira Calculator How Much Could My Roth Ira Be Worth

Best Roth Ira Accounts Nextadvisor With Time

Backdoor Roth Ira 2021 A Step By Step Guide With Vanguard Physician On Fire Roth Ira Vanguard Roth

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Historical Roth Ira Contribution Limits Since The Beginning

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

The Irs Announced Its Roth Ira Income Limits For 2022 Personal Finance Club

Roth Ira Calculator Excel Template For Free

How To Max Out Your Roth Ira In 2021 Imperfect Finance

Contributing To Your Ira Start Early Know Your Limits Fidelity

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Investing Investing Money Roth Ira

Strata Trust Company Twitterren Use This Roth Ira Calculator To Compare The Roth Ira To An Ordinary Taxable Investment Https T Co Zkaxyfaumr Retirementplanning Https T Co 5hzwv5jvbl Twitter

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Roth Ira Vs Traditional Ira Roth Ira Investing Traditional Ira Personal Finance Quotes

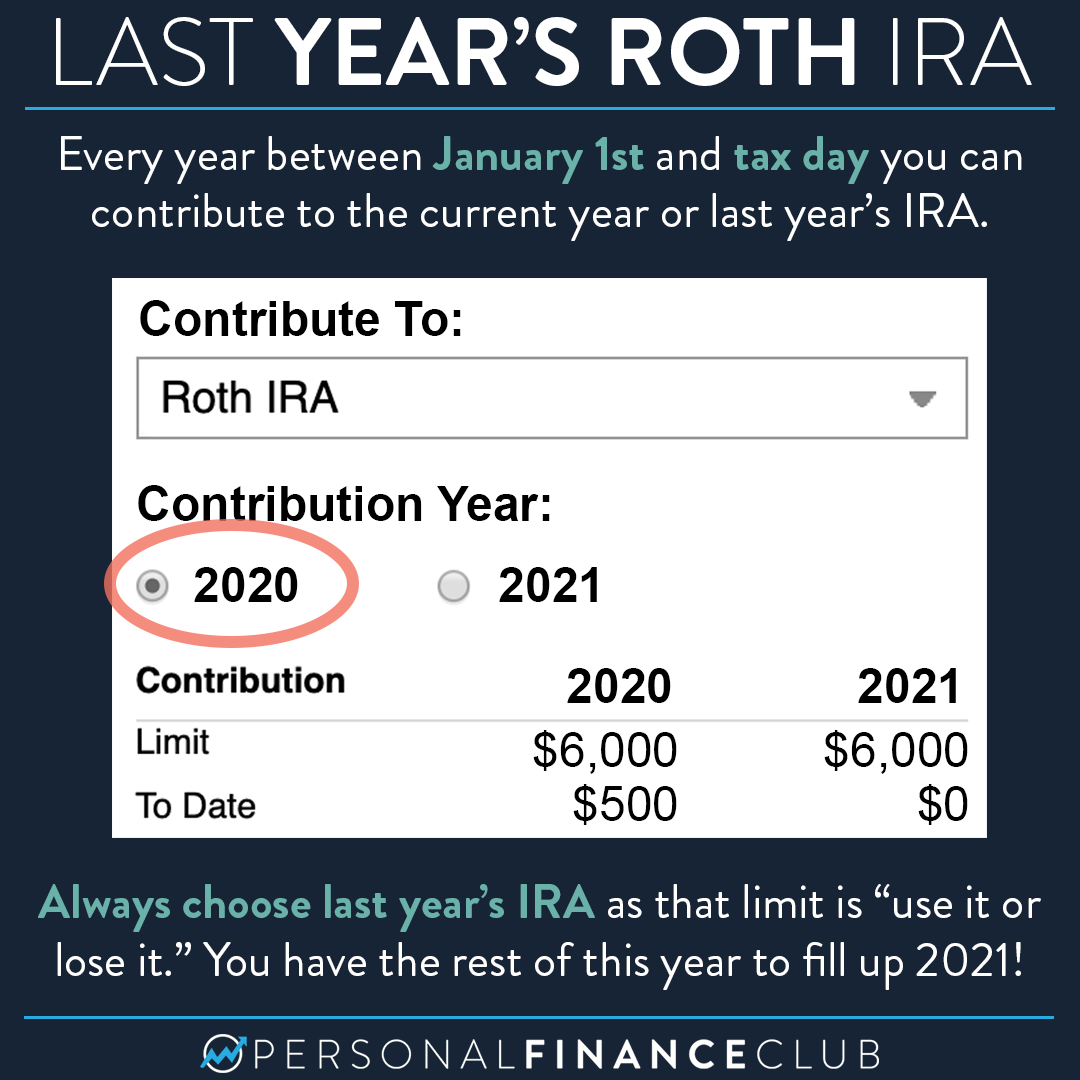

Can I Still Contribute To My 2020 Roth Ira Personal Finance Club

New 2021 Mileage Reimbursement Calculator Mileage Reimbursement Mileage Calculator

Roth Ira Calculator Calculate Tax Free Amount At Retirement